ELIM is bullish on the future of rental housing, driven by a perfect storm of factors: a persistent housing shortage, rising affordability concerns, and a growing preference for renting among various demographics. In 2024, the company strategically invested in six diverse rental properties, including student housing, built-to-rent communities, and multifamily project, reflecting this bullish outlook.

Explore Our Assets

Explore Our Assets

Explore Our Assets

Explore Our Assets

builder partner network

Explore Our Assets

Explore Our Assets

Explore Our Assets

Explore Our Assets

ELIM 2.0

A Leader in Real Estate.

ELIM Investment Management is a privately held real estate investment firm with over 10 years of experience to underwrite, acquire, structure, manage and service real estate equity and debt investments in United States and Canada.

OUR CULTURE

Real Estate is a long term ownership. We focus on professional development and relationship with all stakeholders in our business

OUR CULTURE

Real Estate is a long term ownership. We focus on professional development and relationship with all stakeholders in our business.

OUR TEAM

Our team has managed its investments in private real estate equity and debt through distinct market cycles. We focus on interest alignment and provide custom investment portfolios for institutional investors, private clients and family offices to help them achieve their investment objectives.

Diversifying Your Portfolio with Income and Growth Strategies in Real Estate

Core-Plus Strategy

Class A Properties with above 95% existing occupancy, expected annual returns range from 10-13%. Moderate Leverage with debt levels around 60%. High-quality tenants in good locations.

Value-Add Strategy

Class B to A Properties with above 85% existing occupancy, expected annual returns range from 13-16%. Higher Leverage with debt levels around 65%. Enhancing value through improvements, lease optimizations and increasing occupancy rates.

Opportunistic Strategy

Class A New Development Properties in desired locations, outsized returns. Higher leverage and/or preferred equity. Established builders and property managers with solid track record.

Download Brochure

Please download our Company introduction to learn more our investment approach, track record, and how we work.

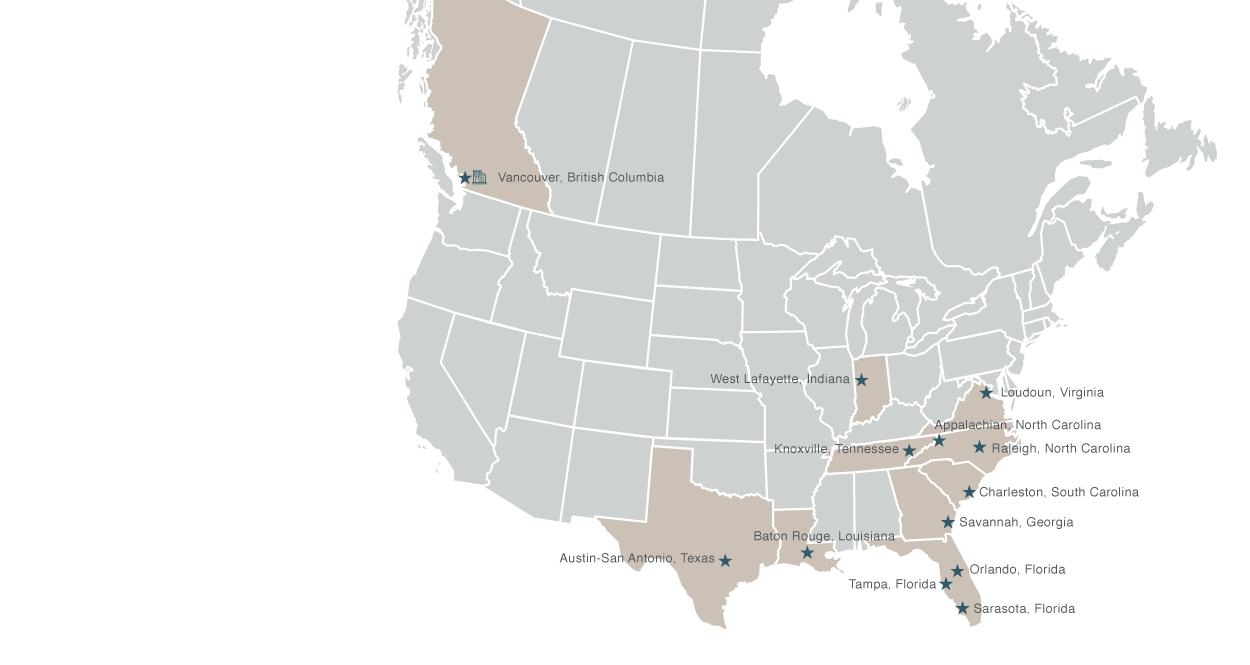

Our FootPrint

ELIM identifies and capitalizes on investment opportunities in regions demonstrating robust rental growth and property appreciation potential. We prioritize regions with strong fundamental economic indicators, including consistent job growth, population growth, and strong business activities. Our focus is exclusively on the acquisition and development of rental housing assets within the United States and Vancouver, Canada.

News and Insights

ELIM is thrilled to announce the recent acquisition of a premier multifamily asset in partnership with Presidium in Manor, part of the thriving northeast Austin area in Texas!

The multifamily real estate sector has shown remarkable resilience and adaptability, making it a prime target for investors looking to get ahead of the next cycle. As we navigate through 2024 and entering into 2025, understanding the current trends and strategic approaches can provide a competitive edge.