Investment process

Our rigorous investment approach is designed to meet our long-term objective of delivering exceptional returns and services while minimizing risks and costs

IDENTIFY TARGET MARKET AND ASSETS

- Market Research include Job, Population, Inventory, Pricing

- Property Due Diligence

- Current and Future Comparable

- Development or Neighborhood Restrictions

ASSET ACQUISITION AND UNDERWRITING

- Capture favorable entry prices

- Exceptional skill and trusted reputation in sourcing off-market deals

- Expertise in Proforma evaluation and underwriting (hands-on approach in budgets in project costs)

DEVELOPMENT / VALUE-ADD STABILIZATION

- Development Design and Timeline Management

- Property rehabilitation

- Market repositioning and renters attractions

- Hands on Know-the-Market Management

EXIT

- Maximize value by offering buyers high quality, turn-key assets with stabilized cash flow

- Consistently strong, stable tenancy

- Well maintained with desirable amenities and improvements

Where We See Opportunities

Fastest Interest Rate Hike in history and Institutions liquidation needs create value-add and opportunistic investment opportunities. Influx of multifamily supply and reduced starts create a window of opportunity for acquisition and development. Our extensive research and real estate teams identified exciting Repricing opportunities in Real Estate Equity and Debt.

Built To Rent

Pandemic and Affordability forcing demographics shift to the rental market looking for larger living space (work from home) with amenities in community living style

Townhome / Multi-family Residential

High supply and Housing Start trending down stable and high growth market create a demand / supply gap opportunity in 2026 and beyond. (Considering the typical 24-36 months built out timeline)

Student Housing

Enrollment Growth, low vacancy rates, shortage of on and off campus supply, flexible housing options, and favorable leasing terms offer reliable rental income and long-term stability, especially in markets with strong university presence.

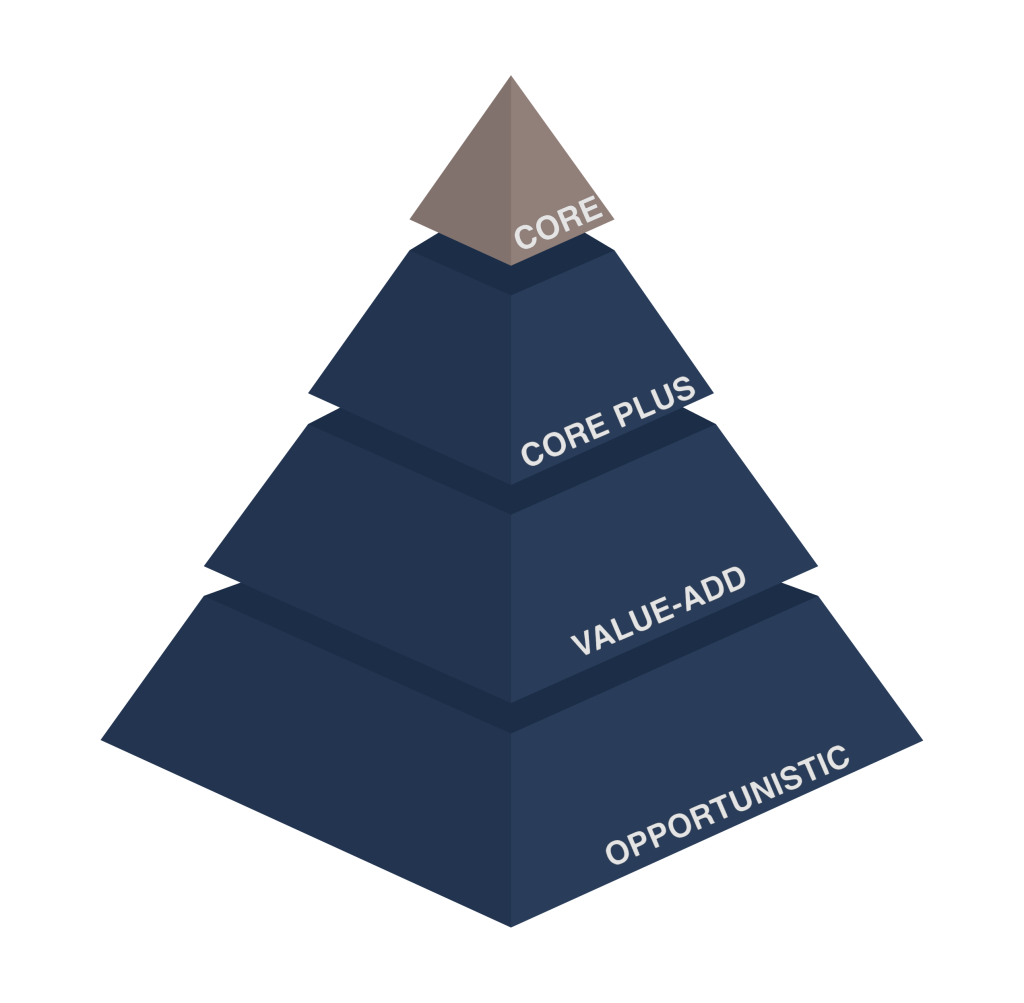

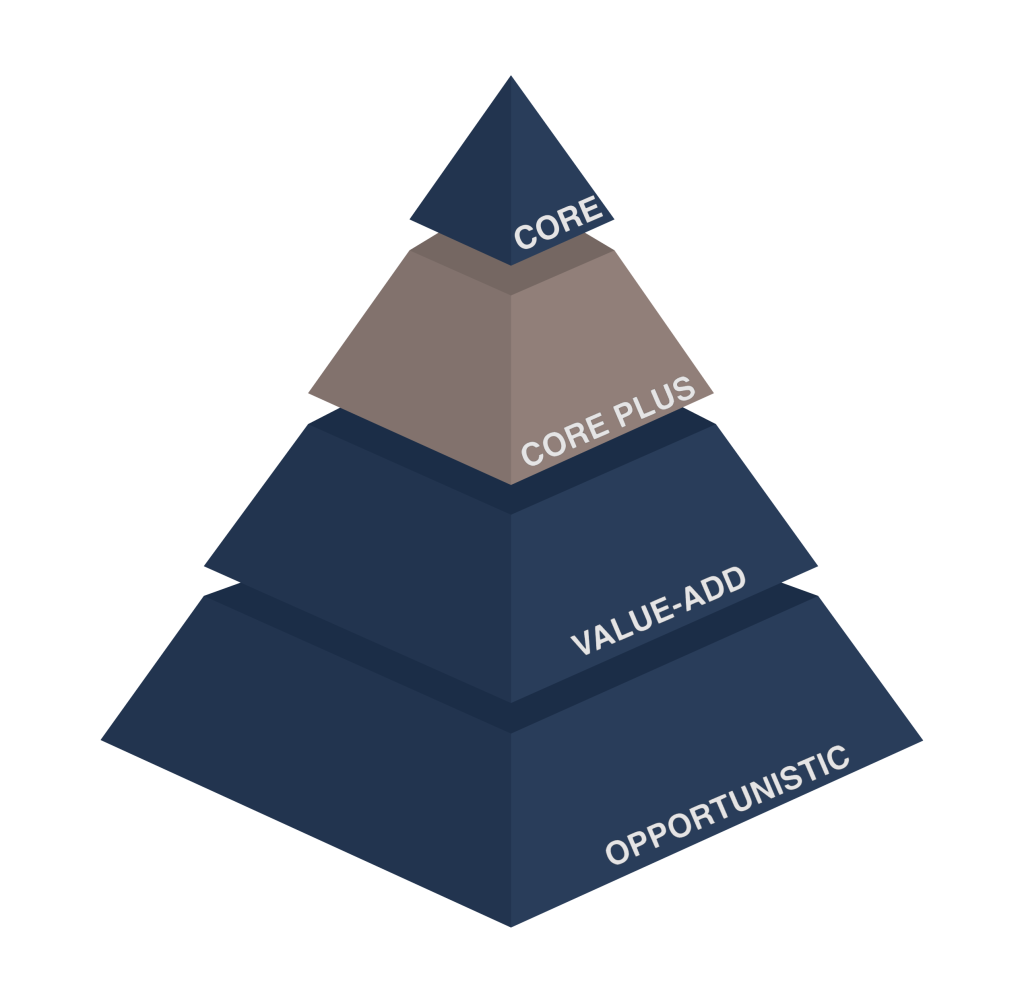

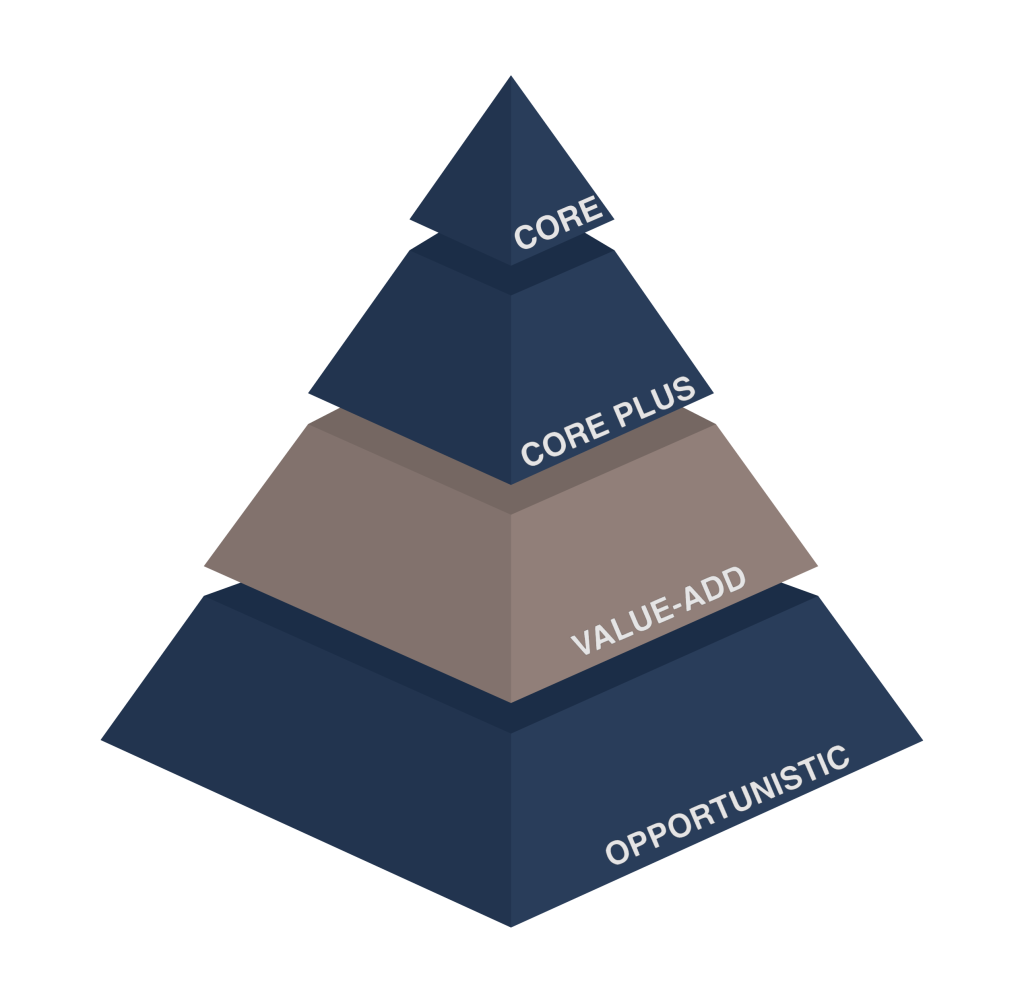

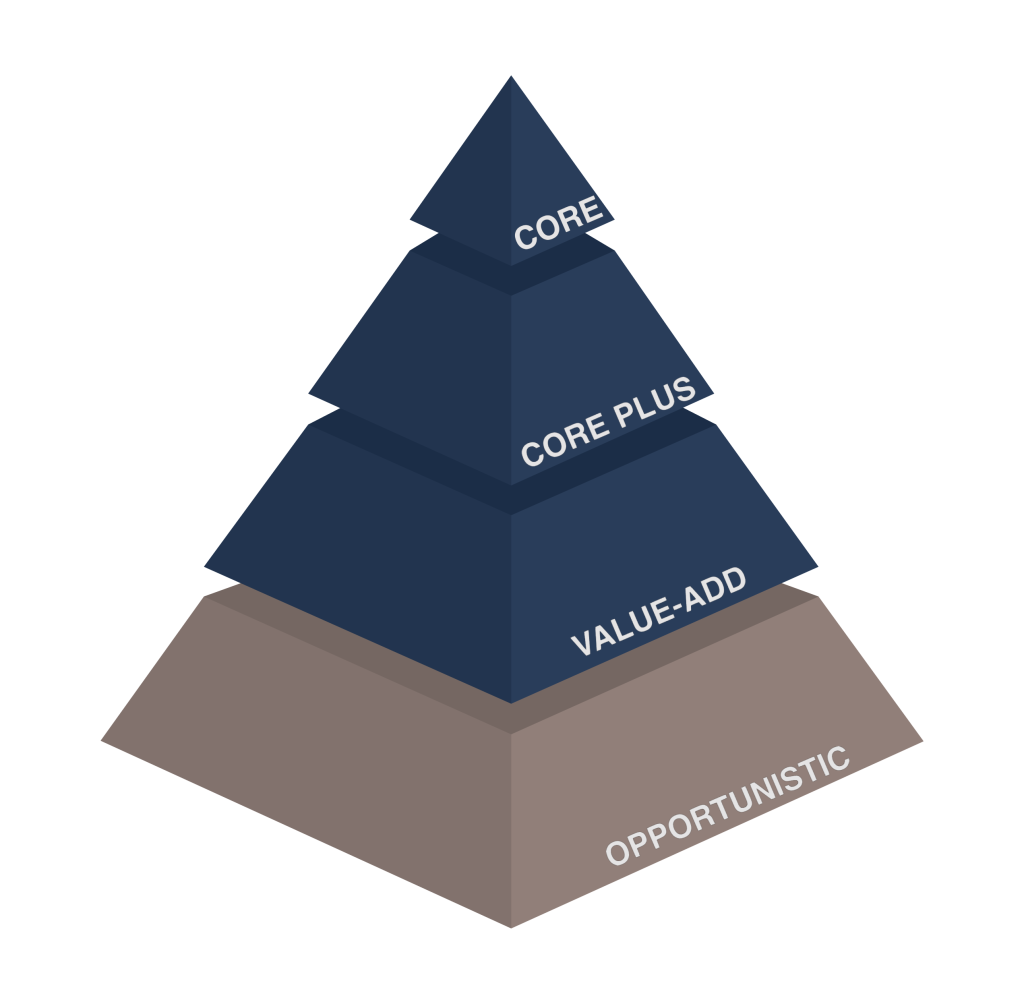

REAL ESTATE EQUITY

CORE INVESTMENT

- Low-maintenance income-producing properties

- Offer stable cash flow with low risk

- Long-term timeframe (10+ years)

CORE PLUS INVESTMENT

- Stable properties with upside potential

- Moderate return (Income + Growth)

- Low to moderate risk

- Medium timeframe (~5 years)

VALUE-ADD INVESTMENT

- Renovation projects with transformation potential

- Focus on growth potential with moderate risk

- Short and medium timeframe

- Repositioning Class C Multifamily, vacant buildings

OPPORTUNISTIC INVESTMENT

- Ground-up property development (Build-to-rent, BTR)

- High-risk, high-reward opportunities

- Mostly focus on growth potential upon exit

- Short timeframe (3 – 5 years)